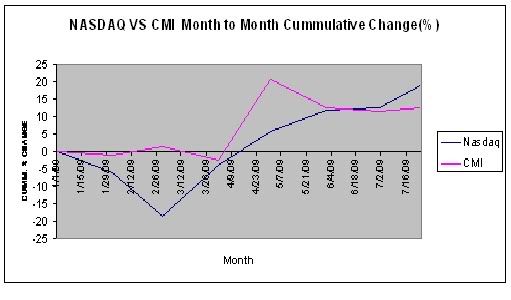

Although the Nasdaq is making the CMI look like a mud encrusted hippo with 20+% year to date gains versus the 10+% CMI gains, it is interesting to see a comparison between the two for cummulative year to date gains, or more specifically, how they got to where they are now. The Nasdaq took a big dip prior to it's upward move from the March low while the CMI held steady through that same period of time.

I'm not trying to make excuses for the CMI's slow reaction to the market changes but looking at the chart below, which line would cause you to lose more sleep. The blue Nasdaq line is pushing into the mid-20's but had to recover from a deep drawdown unlike the more steady CMI.

Note that the chart is based on month to month results (Jan 1st to Feb 1st etc.) so there is less turbulence seen here than if the chart was based on day or week fluctuations. The 'smoothing' of these lines was intended because the CMI is a longer term commitment rather than a day or swing trading vehicle. Also the recent increase in the Nasdaq was not recorded on this graph. The divergence between the July results of the Nasdaq and the CMI is greater, favoring the Nasdaq in YTD gains by approx. 14%.

Friday File: Quarters of Boom and Bust

43 minutes ago