As with my stock selections, I like review some of my predictions during the year to see just what I was thinking at the time. Sometimes I find that things worked out well, other times I feel the need to visit the Positivity Blog to try to forget what a "dumb as" I was for making such a bad call. Let's go back in time...

On December 20th 2009, Sigmund said:

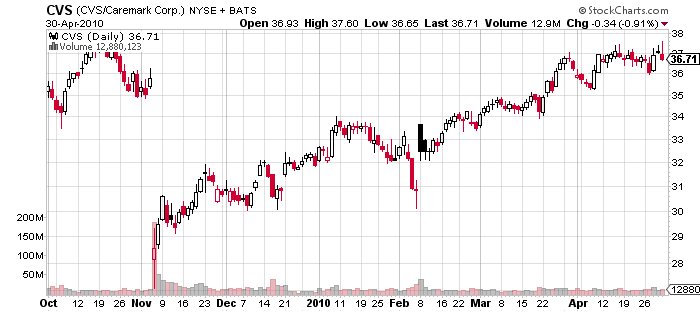

CVS (once again) currently trading at $31.18 and just coming off a big correction. Even a baboon can see that the gap will get filled.

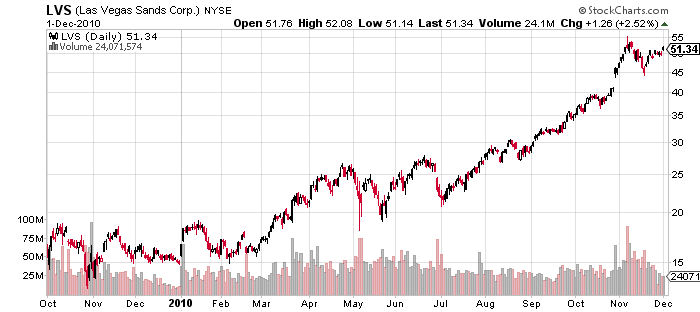

LVS (Las Vegas Sands, Corp) currently trading at $15.29. The year to date chart looks like a technical analyst's dream. Could this be going to $30? I'm betting on it.

My domination of CVS continues...

I will also predict that prescription drugs will lead to more damaged livers and premature deaths in 2011. Some things are just too obvious.

As for Las Vegas Sands...looks like this was as easy as putting an MIT-educated card counter in front of a two-deck shoe.

_______________________________________________

On December 29th 2009, Sigmund said:

The dart has been thrown at Universal Insurance Holdings, Stock Symbol: UVE. I'm convinced that this little insurance dynamo will head north in more ways than one. Expect expansion out of Florida, higher stock price, and hopefully more volume. I'll hold this one until it hits $7 or until the next dividend announcement...whichever comes first.

This didn't last long. UVE peaked at around $6.70 on Jan 11th from $5.75 in late December, and is currently in the $4-5 range. Ugly, I know. If you didn't grab the 16% gain in time, let's hope you had some insurance.

_______________________________________________

January Barometer On a Roll....of incorrect predictions.

I post the expected market direction of the January Barometer at the end of the first month of the year. The Barometer has a stellar record of bull market predictions; but this is not the case when calling for a bearish year. With the market ending down at the end of January 2010, I went along with the trend and got it wrong again.

________________________________________________________________

On April 6th, 2010, Sigmund said:

If the CMI decides to give a little back I would still predict, based on the last three months, that a 54% year-end gain is possible. But you didn't hear that here since prediction is off limits in the rainforest.

I'm glad predictions are off limits in the rainforest. An "almost 30%" gain for 2010 is not the end of the world. We will see where this final trade for 2010 ends up. I predict it will be below 54%.

If anyone was crazy enough to follow every QID/QLD signal since the beginning of MonkeyThrowDart time, that "someone" would have had an average annual gain of close to 30%, or a total gain of 57% for the two years of Q-swapping fun. This is an under-performance by any jungle standard but it ain't over till the fat monkey sings.

Wednesday, December 22, 2010

2010 Prediction Retrospective (Part One)

Labels:

Prediction Retrospective