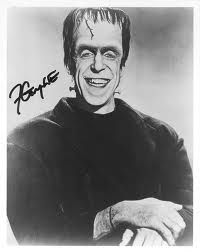

The Cheetum Market Indicator is my favorite tool in the trading box. It's the closest thing to something I always wanted to create -- a living, thinking Frankenstein's monster,

or maybe something more like that Weird Science primate.

A couple of years ago, I would often trade against the CMI and compare results. My second guessing ended up costing me more than I ever expected. As far as I can tell, the short-term thinking of the CMI is reflected in that red resistance line on the chart below, while I am ready for a straight line to $70 for the QQQ. See related post.![]()

Once in a while, at times like these, I check diversification and correlations of stocks in my portfolio to see whether or not I am buying the same "result". I lean to the negatively correlated side (good diversification) during uncertain times, and positive correlation (moderate to poor diversification) when in a strong trend.

The CMI's "kid brother" is the rotation method that I use for three iShare ETF's. I have been doing this for several years, and recently switched to all iShare funds. Using Sharpe's ratio, I trade these ETF's and rotate them at the end of the month, if necessary. So far, IWM has been the only trade since the beginning of the year. Sticking to that plan is important. Sometimes I feel like selling out of the ETF during the middle of the month when the market is not cooperating, but history shows that it's better to stick with the plan and rotate ETF's only once a month.

I'm still holding many long stock positions too. This year's favorite, Sunrise Senior Living (SRZ), has been the king of the portfolio. See related post.

Of course, if I get a strong sell signal from the CMI or from the longer-term curves and oscillators, the long positions will be on a short leash. They are on the long leash right now.

So, at some point in time, the mind of Sigmund, and the mind of the Cheetum Market Indicator will once again be on similar paths.

(Disregard the strange layout of this post. Blogger needs a slap. Of course, maybe you didn't even notice...Kelly LeBrock has that affect.)

Tuesday, March 29, 2011

Portfolio Review at the Crossroads

Labels:

Market Wrap-Up