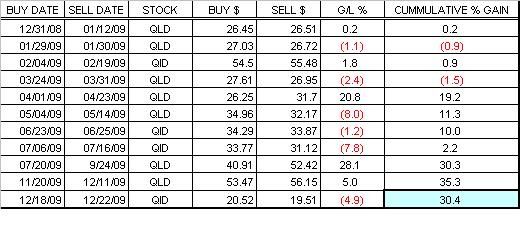

With a couple of days left in the year, there is is no chance of another CMI 1.0 buy signal. Here are the resulting trades for the original CMI:

You can see in the "G/L %" column that it was not always smooth sailing but in the end a 30.4% gain was attained. This was sort of a disappointment since the final results underperformed relative to the Nasdaq. Doubling the Nasdaq was always the unspoken goal. There were also many missed opportunities during the 'no trade' times. This was meant to add some safety to the method but in a trending market it proved to be more of a hindrance.

I had seen the limitations of this method early on and spent the last few months working on a more responsive trading method that I now call the CMI 2.0. This method will now be tracked and all signals will be generated from this new trading method.

As you can see in the left sidebar, the bull is back. It has been back since last Thursday and has increased my trading capital by 7.9%. I would like to get out of this overbought market but I will instead 'stay the course' and wait for a sell signal. Second guessing these methods can be quite costly and as someone once said, "Scared money doesn't make money". I hope whoever said that is still blowing his nose with $100 bills.

skip to main |

skip to sidebar

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

About this Site

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

Jungle Search

Sigmund's Blog List

-

-

-

Things Change18 hours ago

-

Project Apex2 days ago

-

-

-

An Autopsy of American Exceptionalism10 months ago

-

This is the end2 years ago

Popular Posts

Posts By Category

- Market Wrap-Up (105)

- Stocks (78)

- QLD (46)

- Stock Screener (29)

- Fun Stuff (28)

- QID (28)

- CMI 2.0 (23)

- Cheetum Method (22)

- Book Review (13)

- Linkages (13)

- CMI 3.0 (10)

- Coppock (8)

- MensaMonkey (8)

- Options (7)

- Best Trading Day (6)

- Cheetum Price/Earnings Oscillator (5)

- Fed (4)

- Prediction Retrospective (4)

- CMI 4.0 (3)

- January Barometer (3)

- Puts 9/11 (3)

- 2% Solution (2)

- Alpha test 2010 (2)

- Alpha test 2011 (2)

- ETF's (2)

- Gaps (2)

- PSQ (2)

- Super Bowl Indicator (2)

- Dow/Gold Ratio (1)

- Ponzi (1)

- The End (1)

- Welcome (1)

- XLI (1)

Posts By Month

Tree Mail

sigmundbc@hotmail.com