Warning: The following post contains a lot of words and no Batman references whatsoever.

After 57 trades using the Cheetum Market Indicator, it is clear that market volatility and consolidation periods tend to produce results that underperform. With only one signal generator, anything other than an extended trend could put the system in a negative position with relative ease.

Recent changes to the system included adding confirmation signals, and a slower signal generator which, as it turns out, provides a more robust signal. Using this slower signal generator, and confirming this slower signal with the faster (original) signal generator is a vast improvement due to it's ability to ride out volatile periods while providing excellent results during extended trends.

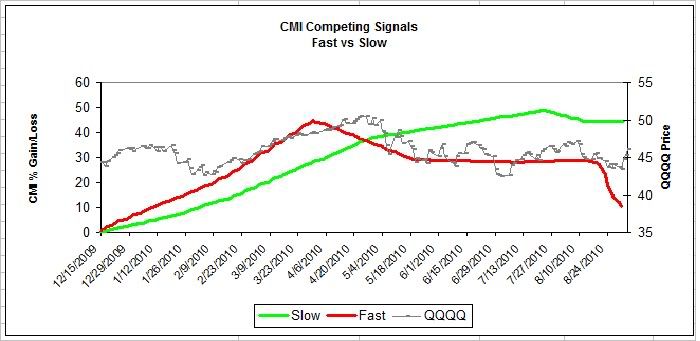

The cumulative % gain/loss chart below shows this clearly...

The red line represents actual trading using the original signal generator. The first few months of the year (through April) exhibited fairly smooth trends resulting in a cumulative 40% gain since mid-December when actual trading commenced. Looking past April, the gray QQQQ price line shows increased range-bound volatility. The red line (original signal generator), in early May, immediately gave up a portion of the initial gain before wavering over the next few months, and finally dropping off the cliff this week giving up all of the year-to-date gains. Note: Intra-trade volatility is not shown here since this chart only plots the closing result of each trade.

Compare the results of the fast signal (red line) with the use of a slow signal (green line) over the same period starting in mid-December 2009. Similar results are achieved through April, but the slower signal rides the volatility during the months of May through August. This requires holding a position through sizable swings, but reduces whipsaw type trading during short-term oversold, overbought cycles.

The period between May and August offered easy opportunities to play the overbought/oversold cycles using simple stochastic oscillators but this method of 'trading' will eventually fall short as a trending market, or even 'choppier' markets develop.

What's the Point, Anyway?

It is not surprising that a mechanical trading system requires some type of revision(s) as actual trade results accumulate during varying market cycles. Back-tested results are no substitute for actual trade results. With that said, the original objective is still clear:

Develop a system using alternating ETF's and inverse ETF's that

(i) produces consistent gains annually, and (ii) outperforms the market.

What's So Bad About Being "Slow"?

Limitation of using this slower signal generator are very obvious when reviewing history:

1. Delayed reaction to fast moving market swings.

2. Potential for generating short-term false signals.

Fast moving markets will result in temporary draw downs which should correct themselves over time. Short-term false signals occurred 22% of the time since the beginning of 2010 when this signal is used independently. Used in conjunction with the other confirming signals, the number of false signals should be reduced by half.

A Four Month Year? The Pressure is On!

The true test will be the upcoming four month performance of the CMI 2.0. A permanent bounce off the zero line will confirm the enhancements to this system.

Note: Looking at the above chart, the end of the red line still shows a gain. This is a gain since mid-December, but year-to-date results are at zero. Either way, an upward move of the red line from this point forward is the path to confirming the viability of this new robust signal generator.

A New Trading Signal Arrives

A new "buy" signal (QLD) was generated for the next trading day (9/7). Looking at the recent four day performance of the market, I would expect some initial retracement of this near vertical climb. My preference is to continue to hold a QID position for the next several months but opinion has no 'say' when testing a mechanical trading system.

Shoot For the Stars or Crash and Burn?

I will follow the next four months in the usual method in the sidebar under 'Current CMI Trades', but will show the expected bounce off the bottom graphically from time to time through the end of the year.

Has the final piece of a reliable profit generating market direction indicator been put into place? A bounce off the bottom from here that outperforms the market by year-end should answer that question.

skip to main |

skip to sidebar

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

About this Site

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

Jungle Search

Sigmund's Blog List

-

-

Altucher Alert: SpaceX Buyout Target?4 hours ago

-

-

-

-

-

An Autopsy of American Exceptionalism10 months ago

-

This is the end2 years ago

Popular Posts

Posts By Category

- Market Wrap-Up (105)

- Stocks (78)

- QLD (46)

- Stock Screener (29)

- Fun Stuff (28)

- QID (28)

- CMI 2.0 (23)

- Cheetum Method (22)

- Book Review (13)

- Linkages (13)

- CMI 3.0 (10)

- Coppock (8)

- MensaMonkey (8)

- Options (7)

- Best Trading Day (6)

- Cheetum Price/Earnings Oscillator (5)

- Fed (4)

- Prediction Retrospective (4)

- CMI 4.0 (3)

- January Barometer (3)

- Puts 9/11 (3)

- 2% Solution (2)

- Alpha test 2010 (2)

- Alpha test 2011 (2)

- ETF's (2)

- Gaps (2)

- PSQ (2)

- Super Bowl Indicator (2)

- Dow/Gold Ratio (1)

- Ponzi (1)

- The End (1)

- Welcome (1)

- XLI (1)

Posts By Month

Tree Mail

sigmundbc@hotmail.com