I would have been in and out of this current trade a few times if I didn't have a mechanical system to rely on. Looking at technical indicators, candlesticks, and various other oscillating and intersecting lines tend to raise the noise level and not much else.

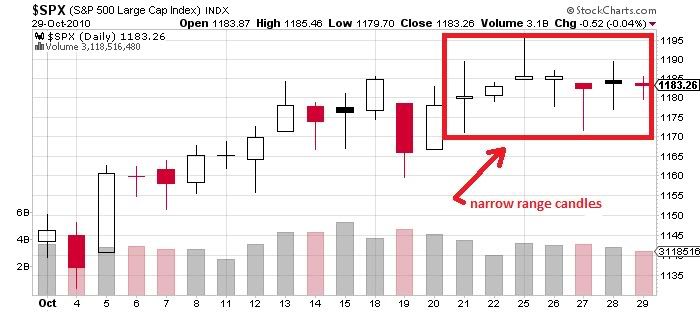

Back in 2008, I kept a record of the CMI 1.0 trade signals and year-to-date results alongside my own trading record and lost in the final year-end tally. No surprise. There is nothing quite like a reliable, emotionless trading system. On that note, the S&P chart below is filling up with several narrow range candles that go by daunting names such as hanging men, gravestone dojis, topping tails, etc. This sometimes indicates a change in market direction.

The Cheetum Market Indicator won't usually make a move until an obvious change in direction makes itself known. A few large white candles next week and these narrow range candles may prove to be just a rest stop for additional upside.

___________________________________________ Halloween is the only day that I get to dress up like a human without the hyenas and anacondas giving me the "stinkeye". Since the Bernie Madoff mask is missing, this year I will be going tree to tree dressed as Richard Ney...again; dressed to the nines, wearing my best suit straight out of Mrs. Miniver, holding a first edition hard cover Wall Street Jungle in one hand, and carrying the severed heads of multiple unsuspecting market specialists from years past in the other. Classy, yet grotesque.

Halloween is the only day that I get to dress up like a human without the hyenas and anacondas giving me the "stinkeye". Since the Bernie Madoff mask is missing, this year I will be going tree to tree dressed as Richard Ney...again; dressed to the nines, wearing my best suit straight out of Mrs. Miniver, holding a first edition hard cover Wall Street Jungle in one hand, and carrying the severed heads of multiple unsuspecting market specialists from years past in the other. Classy, yet grotesque.

Mr. Ney certainly put the 'do' in due diligence. His 'cutting and slashing' writing style along with his sharp wit and through analysis of the scheming market insiders put him in a class by himself. One of the jungle dweller, WH from San Francisco, said it best..."I wish we had 100 Richard Ney's in Govt. Banks and the rest of our corrupt institutions."

The Preface from The Wall Street Jungle, published in 1970 by Grove Press, sets the tone for the next sixteen chapters:

Most of us enter the investment business for the same sanity-destroying reasons a woman becomes a prostitute: it avoids the menace of hard work, is a group activity that requires little in the way of intellect, and is a practical means of making money for those with no special talent for anything else.

With money one achieves status and power of a kind no other means can reach-which in itself would not be unworthy if the methods used to obtain it merited our respect. They don't. It should not surprise us, therefore, that these methods are less than explicit; or that the interests of the Stock Exchanges are solely in their billion-dollar speculations, without regard to their social obligations or the needs of a legitimate auction market.

There is a difference between what is legal and what is legitimate. Once understood, this distinction illuminates an environment in which larceny hides its nakedness in the toggery of law and order, custom and routine. We find it in no man's land of rules and regulations that sanction Stock Exchange members' manhandling of credit and of stock prices on behalf of their own speculations. Short selling, big block fees, special brokerage incentives, and the specialists' investment and trading accounts, are only a few of the methods used to keep the members of the financial establishment established, at the expense of the individual investor.

Much that is painful in our society is due to the public's belief in the cant of the Exchange's chief organs of opinion. Indeed, hidden behind the facade of pompous jargon and noble affectations, there is more sheer larceny per square foot on the floor of the New York Stock Exchange than any place else in the world. It is the legacy of a communal effort that has become the property right, handed down from father to son to grandson. It is sustained by the exclusive allegiance of its high priests to a tradition that wars against reason and that has become so powerful that anyone setting himself against it on behalf of a higher loyalty soon finds he has set himself against a power that is identical to that of government itself.

Clearly, the lunatic economics of this larceny appeal to the criminal. The story is told that after he had been deported to Italy, Lucky Luciano granted an interview in which he described a visit to the floor of the New York Stock Exchange. When the operations of the floor specialists had been explained to him, he said, " A terrible thing happened. I realized I'd joined the wrong mob."

Saturday, October 30, 2010

Hanging Men and Gravestone Dojis Right on Cue

Labels:

Market Wrap-Up