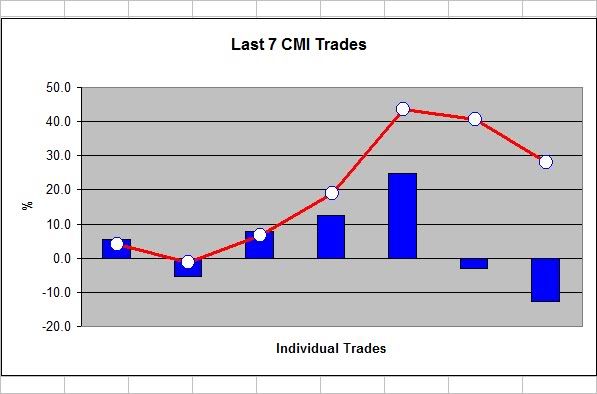

A little late to the party but the bear is back. The CMI 2.0 will be buying the QID at tomorrow's open. The CMI finally surrendered but gave up more than 12% in the process. To get a perspective, here are the last seven trades after that whopping 122% gain from last year. (Yeah, I said whopping).

The blue bars represent the result of each trade while the red line represents cummulative gain of these trades. The time period is Oct 09 to present.

It doesn't look so bad when presented this way. This is not an uncommon pattern as can be seen by the larger scale graph from an earlier post.

We are now QID-friendly. So... down is good, and lets avoid the bear traps.

skip to main |

skip to sidebar

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

About this Site

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

Jungle Search

Sigmund's Blog List

-

-

-

Things Change1 day ago

-

Project Apex3 days ago

-

-

-

An Autopsy of American Exceptionalism10 months ago

-

This is the end2 years ago

Popular Posts

Posts By Category

- Market Wrap-Up (105)

- Stocks (78)

- QLD (46)

- Stock Screener (29)

- Fun Stuff (28)

- QID (28)

- CMI 2.0 (23)

- Cheetum Method (22)

- Book Review (13)

- Linkages (13)

- CMI 3.0 (10)

- Coppock (8)

- MensaMonkey (8)

- Options (7)

- Best Trading Day (6)

- Cheetum Price/Earnings Oscillator (5)

- Fed (4)

- Prediction Retrospective (4)

- CMI 4.0 (3)

- January Barometer (3)

- Puts 9/11 (3)

- 2% Solution (2)

- Alpha test 2010 (2)

- Alpha test 2011 (2)

- ETF's (2)

- Gaps (2)

- PSQ (2)

- Super Bowl Indicator (2)

- Dow/Gold Ratio (1)

- Ponzi (1)

- The End (1)

- Welcome (1)

- XLI (1)

Posts By Month

Tree Mail

sigmundbc@hotmail.com