Nothing in this world can take the place of persistence.

Talent will not; nothing is more common than unsuccessful people with talent.

Genius will not; unrewarded genius is almost a proverb.

Education will not; the world is full of educated derelicts.

Persistence and determination alone are omnipotent.

~Calvin Coolidge

Sigmund Calvin Coolidge

Sigmund B. Coolidge

Sig B. Coolidge

Sig B. Cool

...Cool!

Increasing the winning percentage of the CMI 2.0 is secondary to fixing the 'Achilles Heel' that had shown itself during the April 'flash crash' period. Caught on the wrong side of a down market put the system in a position that it could not correct within a reasonable amount of time. The only 'out' would have been to cut losses when panic set in.

I don't paper trade much since I expect that the research done prior to setting a trading plan in motion will be more than adequate. When it's not, as was discovered in April, no panic selling was allowed and the earlier year-to-date gains were reduced by 13%. Not allowing myself to cut and run gives me more incentive to correct the defect and improve the system...even if it puts a dent in the trading account.

One earlier attempt to assist the CMI using my 'FrankenTurbo' did not work so well. The CMI is of the independent sort and likes to work alone. I am now testing an obscure little add-on, a sort of guidance system, that may keep the CMI from developing a stubborn streak, and reverse the trade when trouble arrives. When my initial testing is done, I'll put it in the sandbox (or quicksand box in this part of the jungle) and see if the CMI plays nice.

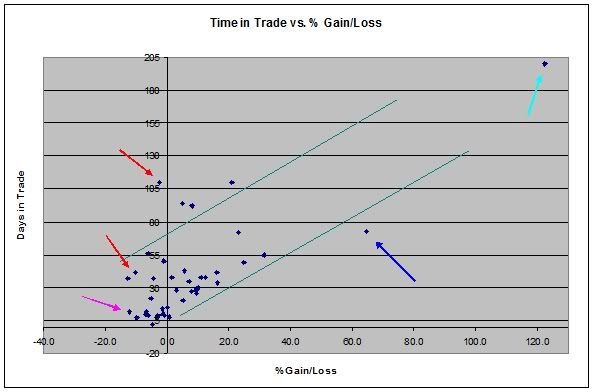

Results have been better than expected so far. See the scatter diagram below. This is an update from the one done in April.

The red arrows indicate the areas that are targeted. These are the trades that resulted in higher than average losses, and much wasted time. The good news is that adding a 'guidance system' may also reduce the group of small losing trades indicated by the pink arrow at bottom left of the diagram.

Note the dark blue arrow. This is an example a well executed trade; a big gain in a short amount of time. The aqua arrow in the top right shows a freak trade that would not quit during that bull market period in 2009. Another one of those would be welcome. That blue dot is getting a little lonely up there.

skip to main |

skip to sidebar

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

About this Site

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

Jungle Search

Sigmund's Blog List

-

-

-

Things Change21 hours ago

-

Project Apex3 days ago

-

-

-

An Autopsy of American Exceptionalism10 months ago

-

This is the end2 years ago

Popular Posts

Posts By Category

- Market Wrap-Up (105)

- Stocks (78)

- QLD (46)

- Stock Screener (29)

- Fun Stuff (28)

- QID (28)

- CMI 2.0 (23)

- Cheetum Method (22)

- Book Review (13)

- Linkages (13)

- CMI 3.0 (10)

- Coppock (8)

- MensaMonkey (8)

- Options (7)

- Best Trading Day (6)

- Cheetum Price/Earnings Oscillator (5)

- Fed (4)

- Prediction Retrospective (4)

- CMI 4.0 (3)

- January Barometer (3)

- Puts 9/11 (3)

- 2% Solution (2)

- Alpha test 2010 (2)

- Alpha test 2011 (2)

- ETF's (2)

- Gaps (2)

- PSQ (2)

- Super Bowl Indicator (2)

- Dow/Gold Ratio (1)

- Ponzi (1)

- The End (1)

- Welcome (1)

- XLI (1)

Posts By Month

Tree Mail

sigmundbc@hotmail.com