Has the perfect storm of market-crash leading indicators arrived? After studying the Coppock Curve last month, then dissecting the Baltic Dry Index for clues of market prognostication, the recent articles on the Hindenburg Omen have redefined the term indicator overload. Let's take this eclectic group and create an ultimate indicator called the Copbalticburg Syndrome. Of course the word 'syndrome' in medical terms means nothing more than "we don't really know what it is, so lets call it a syndrome".

Getting back to the Copbalticburg Syndrome, two events must happen to complete this perfect storm. Someone has to add some fresh eye of newt to this stew, the Hindenburg Omen must repeat it's delicate balance of events in the coming days, and then panic must ensue. If this happens, look out below. All indicators are pointing south, and it won't take much to push the whole kit and kaboodle (yeah, I said kit and kaboodle) off the cliff.

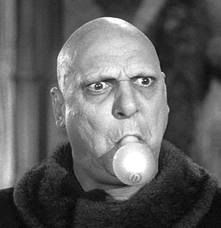

Uncle Fester can handle the first part but the rest is up to you.

Praise that Great Monkey in the Sky that I am fully bearish at the time of this writing. That could change but in the meantime, when you get a chance, maybe on your break, spread the word...the Copbalticburg Syndrome may have arrived, or as the pharmaceutical fellas would say...the market may have developed a bad case of CBBS.

____________________________________________________________________

WSJ article - Hindenburg Omen

More Hindenburg at Safehaven.com 1985-2005

Coppock Curve

Wikinvest explains Baltic dry Index

Tuesday, August 17, 2010

The Copbalticburg Syndrome

Labels:

Market Wrap-Up