Looking back on history, Wednesday's sell off was the 19th worst one day drop since January 2009. It doesn't seem all that bad when you put it that way. The question that comes to mind after a day like that is how soon will the market make up the loss, and how does the current market trend affect this short term recovery?

A typical reaction by some traders to a really bad day in the market is to sell everything, or trade in the opposite direction. But is that sort of knee jerk reaction warranted?

First things first. I will define a one day drop as the close of the previous day to the close of the next day. History in this case will only go back as far as January 2009. Since markets recover eventually (they do, don't they?), let's use a two week maximum time period for the recovery to occur. Also, I will use data from the NASDAQ Composite and look at only those days where the market fell more than 2.5%. Ouch!

To keep things simple and to define a trending market, I will use the ugly, but useful, stepchild of the 50 and 200 day moving average...that would be the 100 day moving average. (Daily prices above the 100 day MA...uptrend; daily prices below the 100 day MA...downtrend). Moving averages are used in the calculations and are not shown in the post.

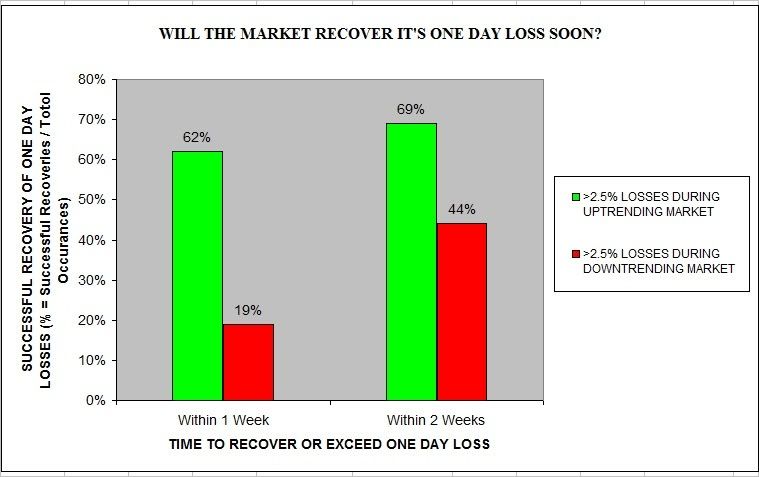

As you can see by the incredibly wordy chart, one day losses greater than 2.5% occurring during uptrending market cycles (identified by the green bars), were recovered or exceeded 62% of the time within five days (8 out of 13 occurrences), and 69% of the time within 10 days (9 out of 13 occurrences). The recovery of losses during the first week were held or exceeded during the second week in all but one occurrence.

One day losses occurring during downtrending market cycles (identified by the red bars), were recovered or exceeded only 19% of the time within five days (3 out of 16 occurrences) and 44% of the time within 10 days (7 out of 16 occurrences) .

Remember that the historical data used only goes back to January 2009, and history does not necessarily predict future events. That being said, last Wednesday's 3% loss occurred under the 100 day moving average which would be considered a downtrend. In this case, I'll let history be my guide.

Sunday, August 15, 2010

Recovering From A One Day Meltdown

Labels:

Market Wrap-Up