Successfully navigating through the market's head fakes and reversals requires, above all else, a specific plan that establishes clear limits when price direction deviates from the intended direction. How far are you willing to drive off the paved road and into the deep jungle? The "off-road" experience may provide the reward of a shorter (or profitable) trip, or could potentially lead to the need for a search and rescue team. Without resolving this issue at the outset of each trade, second guessing and impulse reactions will ultimately lead to regrettable trading decisions.

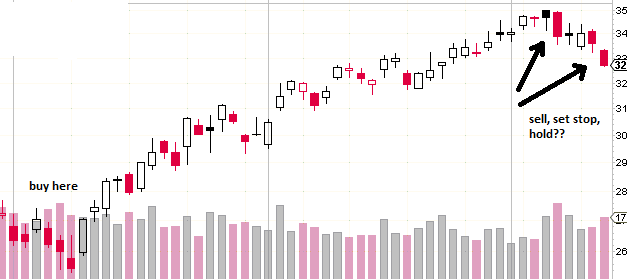

Take a look at the chart below. Assuming you took a bullish stance and bought the market back at the left side of the chart. Is it time to close the trade, set the stop, or sit on the trade?

The only right answer is that the answer should already be known at the time the trade was initiated. The last five days were not so kind based on the long red candles that resulted in a 6.5% drop from the top. One opinion is to make the decision based on the recent market action, but this is not a substitute for pre-determining duration of trade and the extreme limits that the trade will often encounter.

Traders are often blind-sided by extremely fast market action including those unfair overnight gaps in price, but more often, they are caught off-guard by slow, eroding price action that seeps deeper and deeper to a point of no return...right before their eyes.

In hindsight, a longer approach worked out well. The longer term trader made the decision to ride the deeper troughs in anticipation of greater gains. The trader that cut losses at the first dip also retained a profit. The reasons for getting out of the trade may have been due to a pre-determined 8% loss limit. Profit taking at this point was pre-determined, and maybe a better risk/reward set-up was approaching in another trade.

(The charts below and above are actually the 2009 QQQQ's.)

With a clear view at the outset of each trade, a poor outcome may require a change to the method, but at least no excess energy is wasted on decision making when the market unexpectedly veers in the other direction. The overused axiom of "Plan the Trade, Trade the Plan" still rings true.

skip to main |

skip to sidebar

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

About this Site

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.

Hello! Sigmund here. Just a quick word about this site. Monkey Throw Dart is an informational site for traders and investors who are looking for a trading strategy that really works. Using a unique trend-following system, originally called the Cheetum Market Indicator 1.0 (CMI 1.0) which has now morphed into a beast called the MensaMonkey, the goal is still the same: Outperform the market with double digit gains every year regardless of market direction.The stock market will never be a safe place for your savings or trading capital unless you have a plan that includes expert timing, and a good dose of risk management. This site is dedicated to leveling the playing field, or playing jungle as the case may be. No gimmicks or phony promises. Transactions and trading signals are posted as they happen so you can follow along as I sink or swim with every trade.

2013 starts the fifth year of this grand experiment so set your sights on the MensaMonkey's trade signals just below these words because the little primate's market calls are on public display as usual and can change at any time.

To learn more about the MensaMonkey trading, scroll down to the 'Posts By Category' in the sidebar below and look for MensaMonkey, or just click here.

Of course, if you end up losing money due to information posted here, don't blame me. You're the one who took advice from a chimp.

Jungle Search

Sigmund's Blog List

-

-

-

-

-

-

-

-

This is the end2 years ago

Popular Posts

Posts By Category

- Market Wrap-Up (105)

- Stocks (78)

- QLD (46)

- Stock Screener (29)

- Fun Stuff (28)

- QID (28)

- CMI 2.0 (23)

- Cheetum Method (22)

- Book Review (13)

- Linkages (13)

- CMI 3.0 (10)

- Coppock (8)

- MensaMonkey (8)

- Options (7)

- Best Trading Day (6)

- Cheetum Price/Earnings Oscillator (5)

- Fed (4)

- Prediction Retrospective (4)

- CMI 4.0 (3)

- January Barometer (3)

- Puts 9/11 (3)

- 2% Solution (2)

- Alpha test 2010 (2)

- Alpha test 2011 (2)

- ETF's (2)

- Gaps (2)

- PSQ (2)

- Super Bowl Indicator (2)

- Dow/Gold Ratio (1)

- Ponzi (1)

- The End (1)

- Welcome (1)

- XLI (1)

Posts By Month

Tree Mail

sigmundbc@hotmail.com